Visa Junior

This was my graduation project in the final semester of college, where I led the research and design process. I developed a holistic solution that encourages and facilitates financial literacy and healthy money mindsets for children.

Problem Discovery

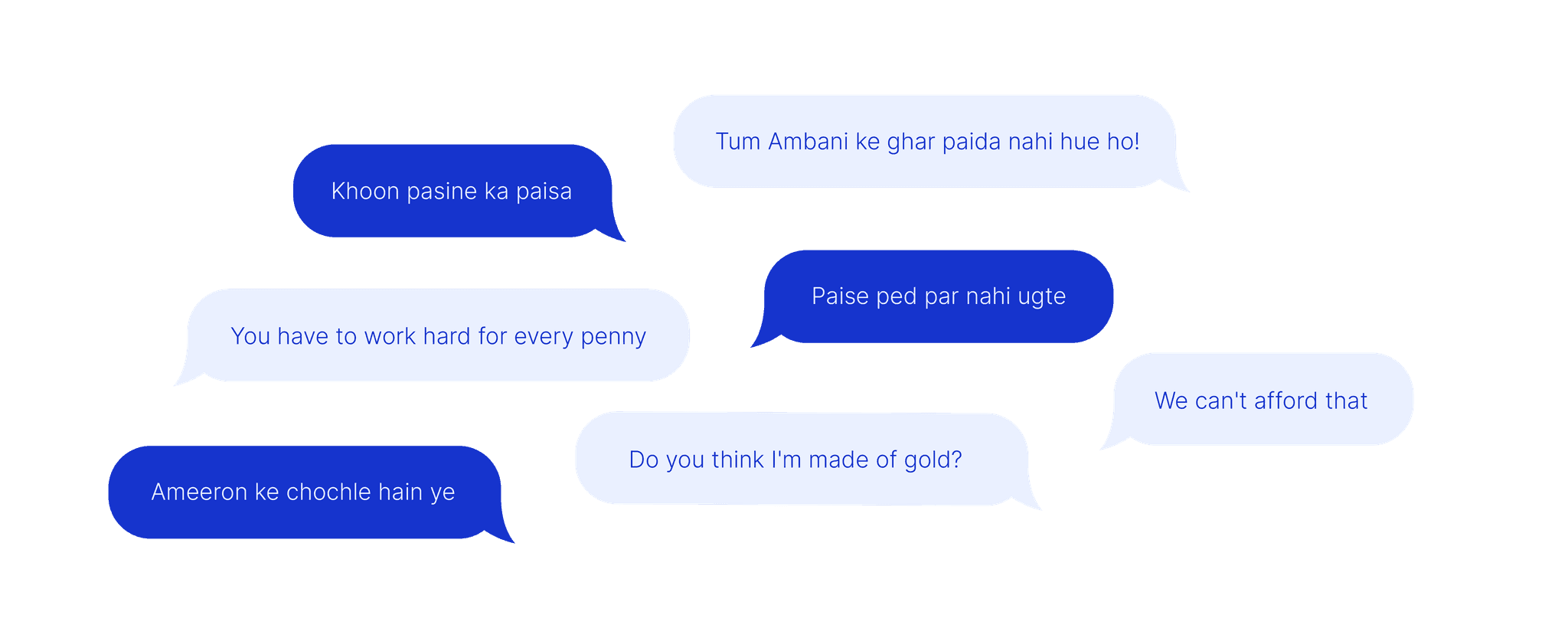

We have all heard our parents say at least one of these lines. Despite these constant reminders about the limitations of money, conversations about cultivating a healthy money mindset or managing finances are rare. This silence around money matters should not continue. Children need to develop a positive relationship with money. By doing so, we equip them with the skills to make informed financial decisions, ensuring a secure and confident financial future.

Problem Statement

There is a significant lack of open conversations about money, particularly those encouraging healthy mindsets, leading to negative attitudes and financial illiteracy in children.

Gaining insights into a child's world by understanding their parents' views

Desk Research & Literature Review

Understanding money mindsets and the current situation of financial literacy

To gain a better understanding of the topic, I read several articles and a few books on financial literacy and money mindsets. This provided valuable insights into the current gaps in financial education and the importance of fostering positive money attitudes from an early age. The findings indicate the need to develop solutions that equip children with essential financial behaviour.

Interacted with parents to understand perspectives on money mindsets and financial literacy. Here are a few topics I asked about. These conversations revealed valuable insights. Some parents expressed indifference toward early financial education, they believed it was unnecessary at a young age. On the other hand, others emphasised its importance and shared the steps they have taken to teach their children about money.

Presenting

Competitive Analysis

Glimpse into the world of finance for children

Based on our research insights, we brainstormed various solutions for helping young adults cope with breakups. Each idea was evaluated based on its potential impact on emotional well-being and how effectively it could offer support. Here are the three ideas we ultimately selected:

Insights & Design Opportunities

Gathering all the insights and compiling them into a cohesive whole

After collecting all the insights, I crafted a detailed mind map to explore and visualize the full range of possibilities.

User Research

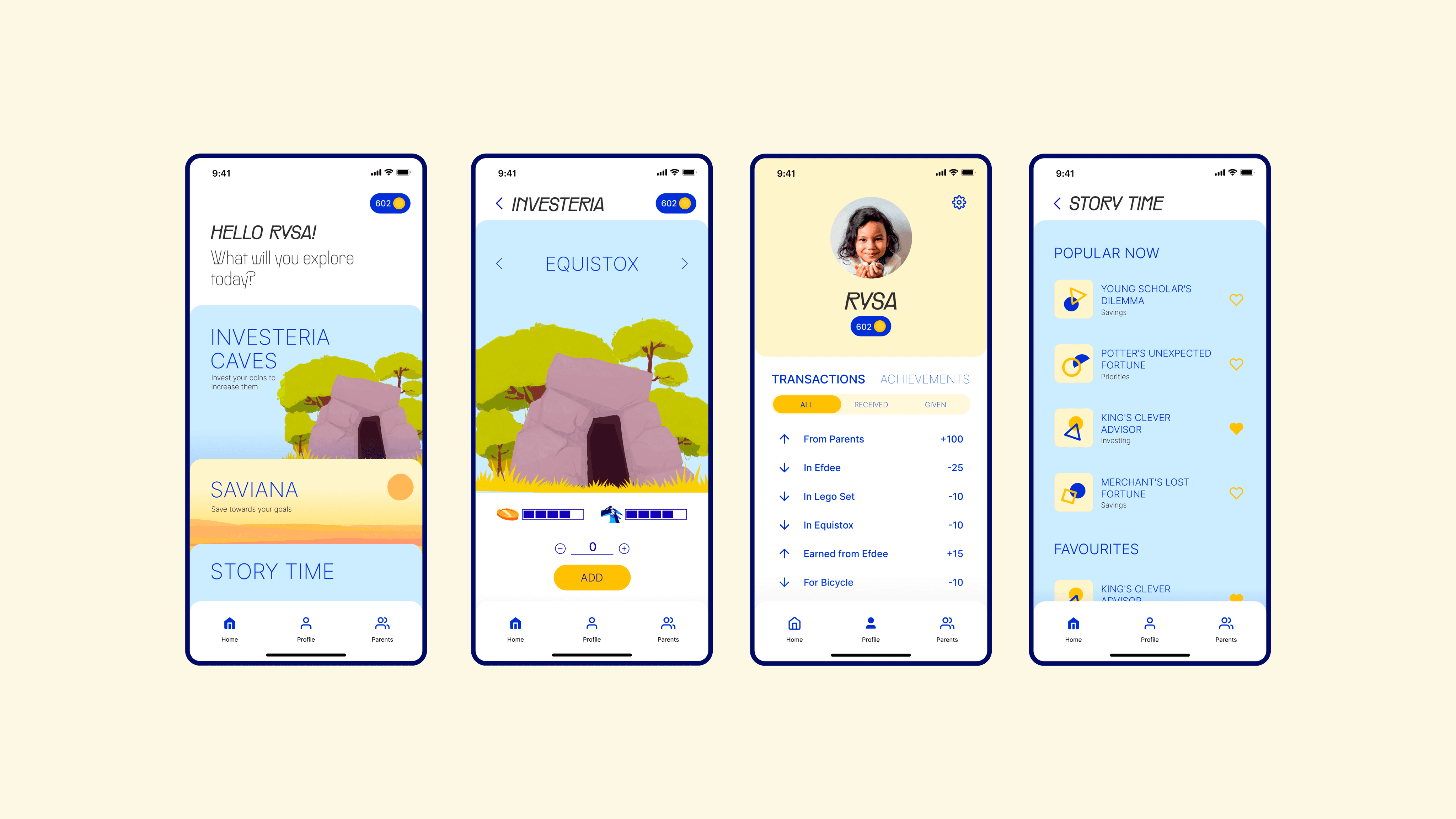

The app is designed to lay the foundation for your child’s financial future. At the heart of financial literacy are two essential pillars: saving and investing. Learning isn’t just about numbers; kids connect best with stories. That’s why Visa Junior combines these fundamental concepts with engaging narratives, making financial education fun and memorable.

Visa Junior - The App

Solution - 2

Mindmap

A recent survey reveals that the majority of parents are not discussing money with their children, with 82% citing fear as a major barrier. Despite this, conversations about money are crucial for developing healthy financial habits. That's where this card game comes in—it provides a fun and interactive way to engage in discussions about money. By using activity and choice cards, families can explore financial concepts and make decisions together, fostering open dialogue and understanding in a playful setting.

Playing Cards

Solution - 1

Visa Junior is an initiative by Visa aimed at breaking the cycle of poor money mindsets and financial illiteracy. It offers three solutions designed to address different aspects of financial education for kids.

The card game comes with a small manual that prompts parents to guide meaningful conversations about money, helping to turn everyday play into valuable financial lessons.

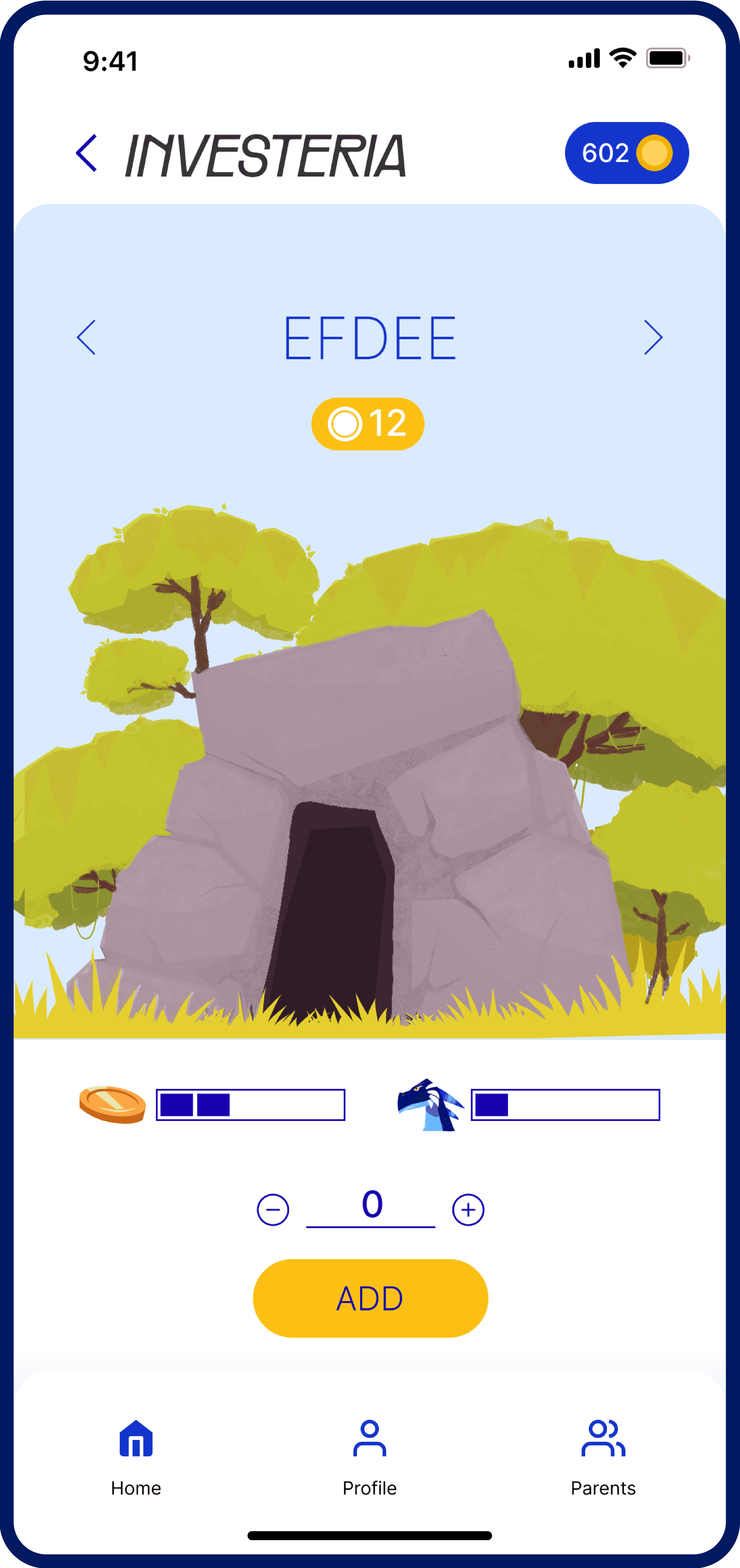

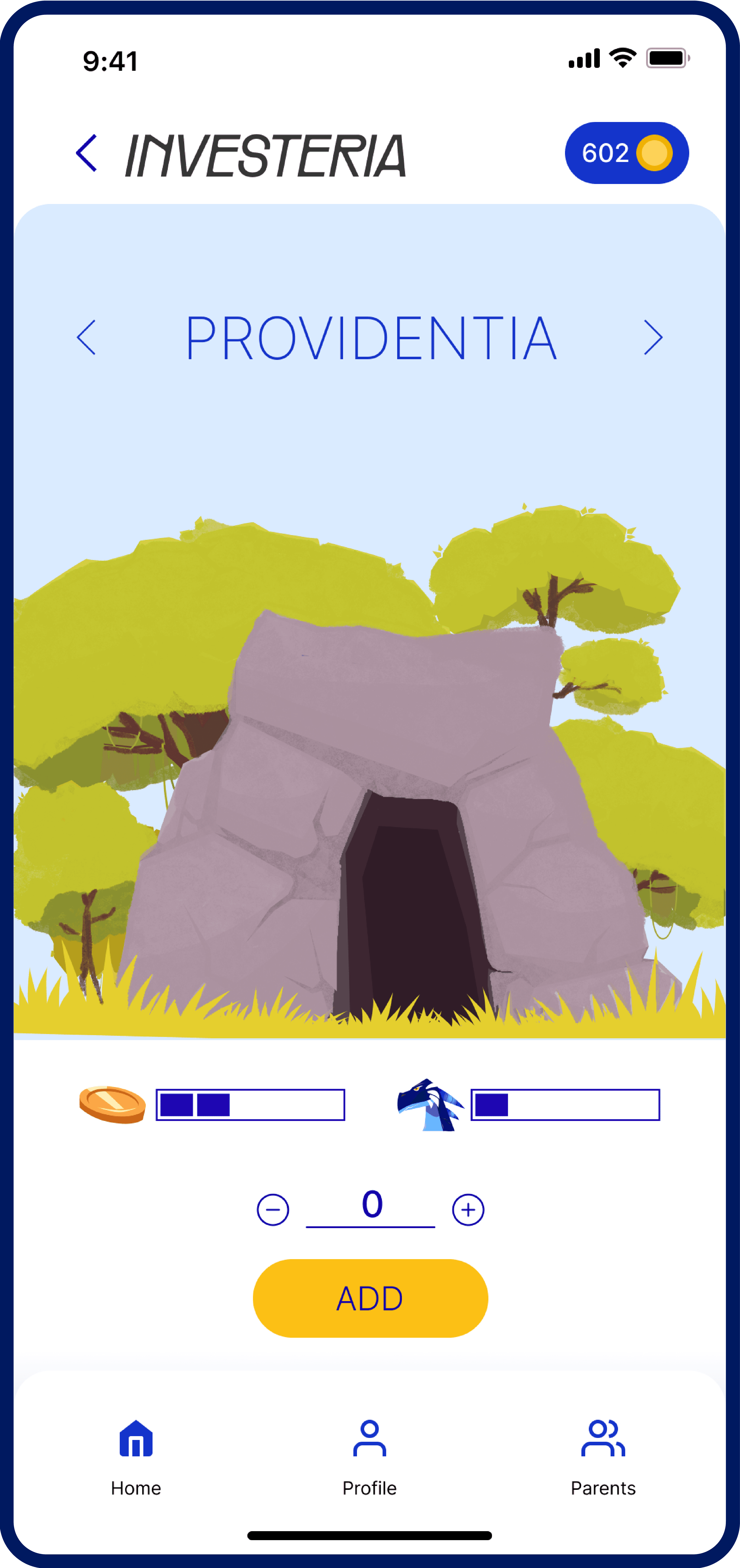

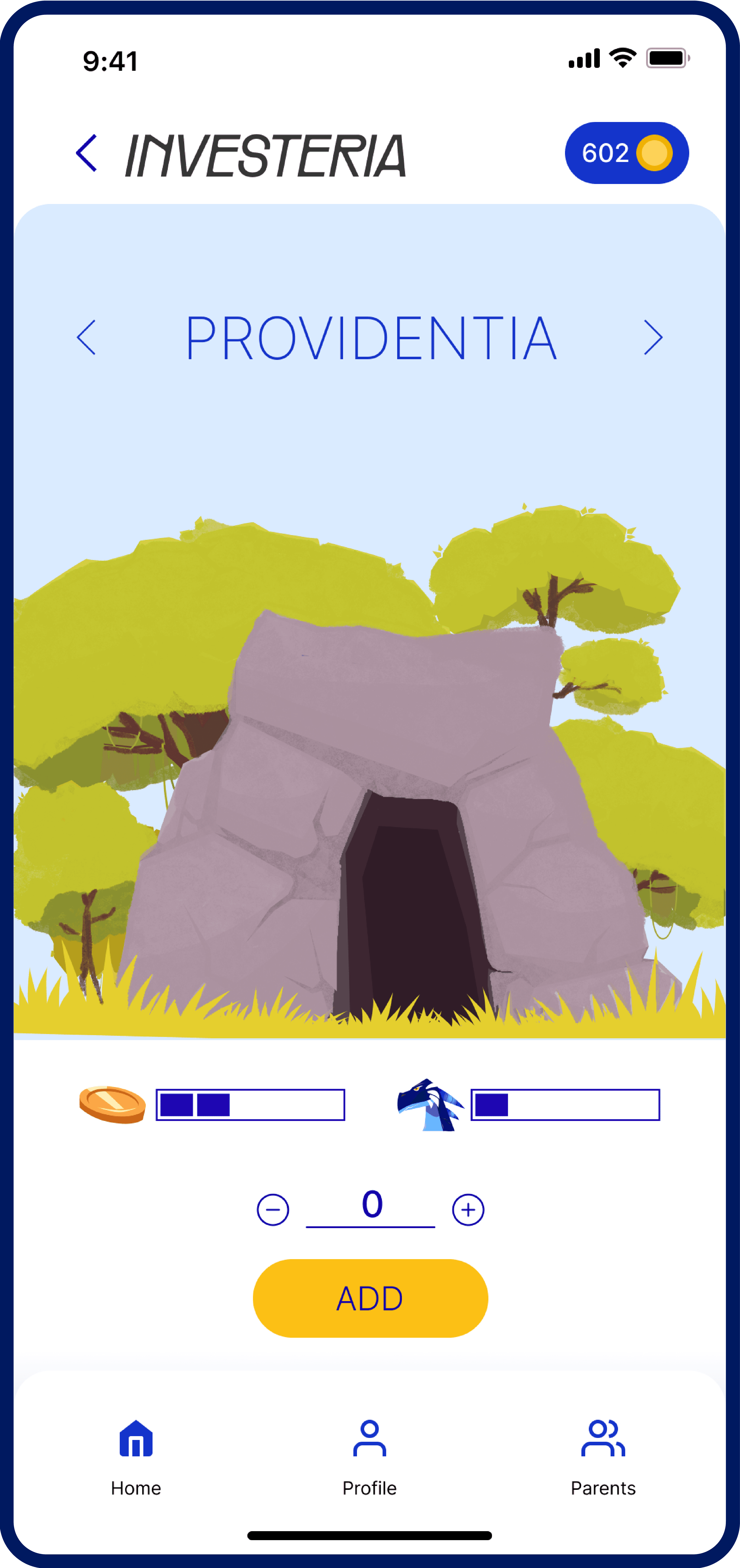

In this section, children will explore the concept of investing. They’ll grasp the crucial balance of risk and reward. This imaginative approach makes the complexities of investing both accessible and exciting.

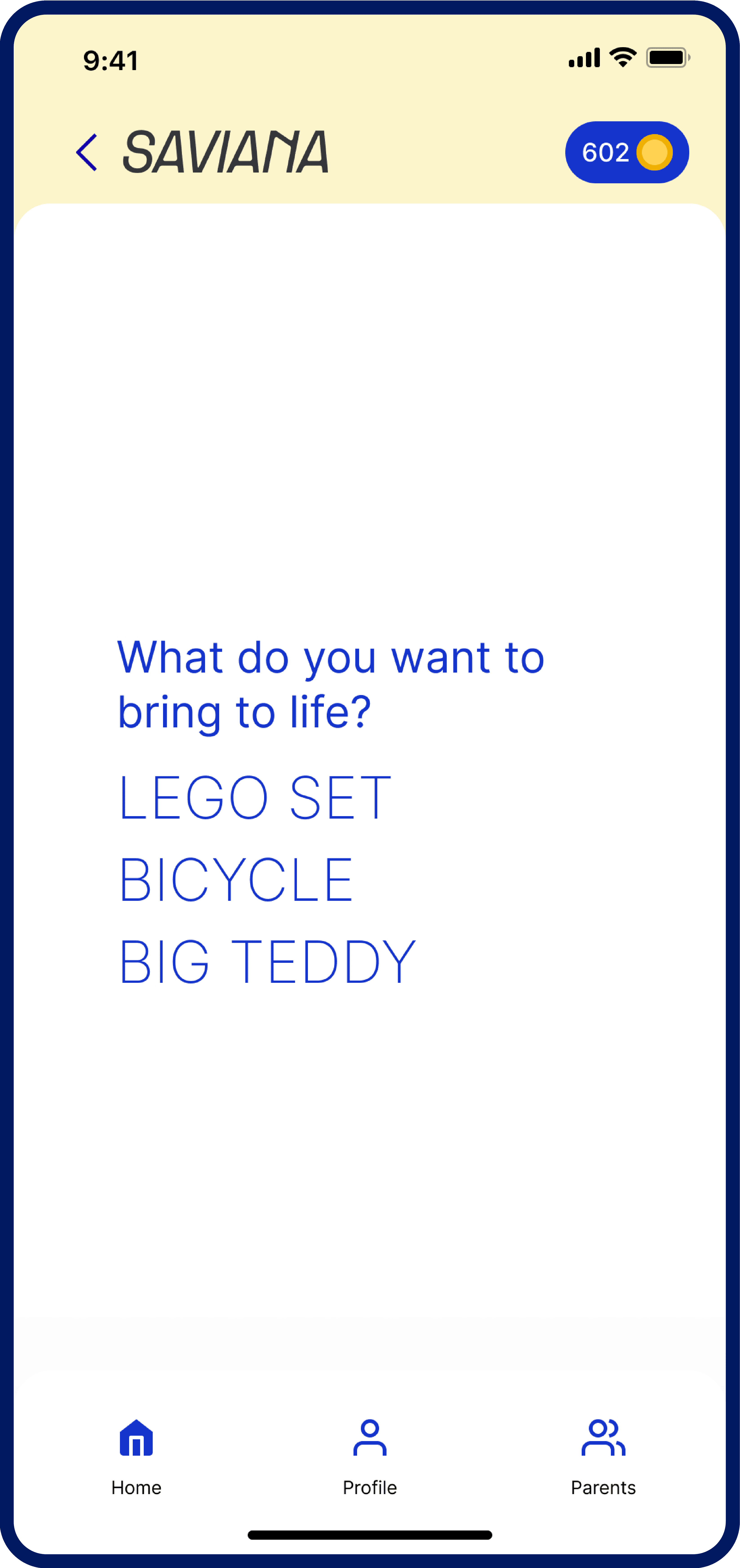

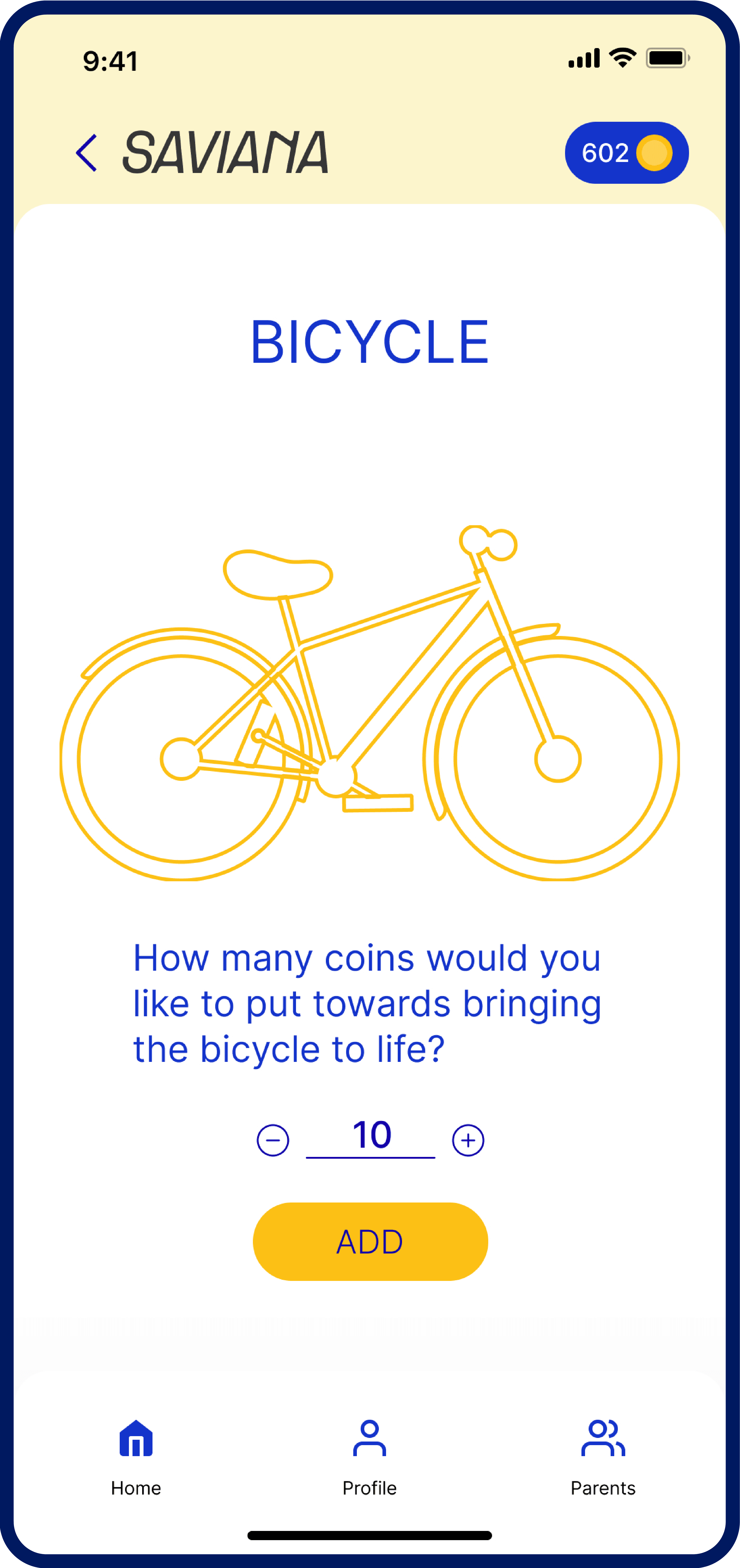

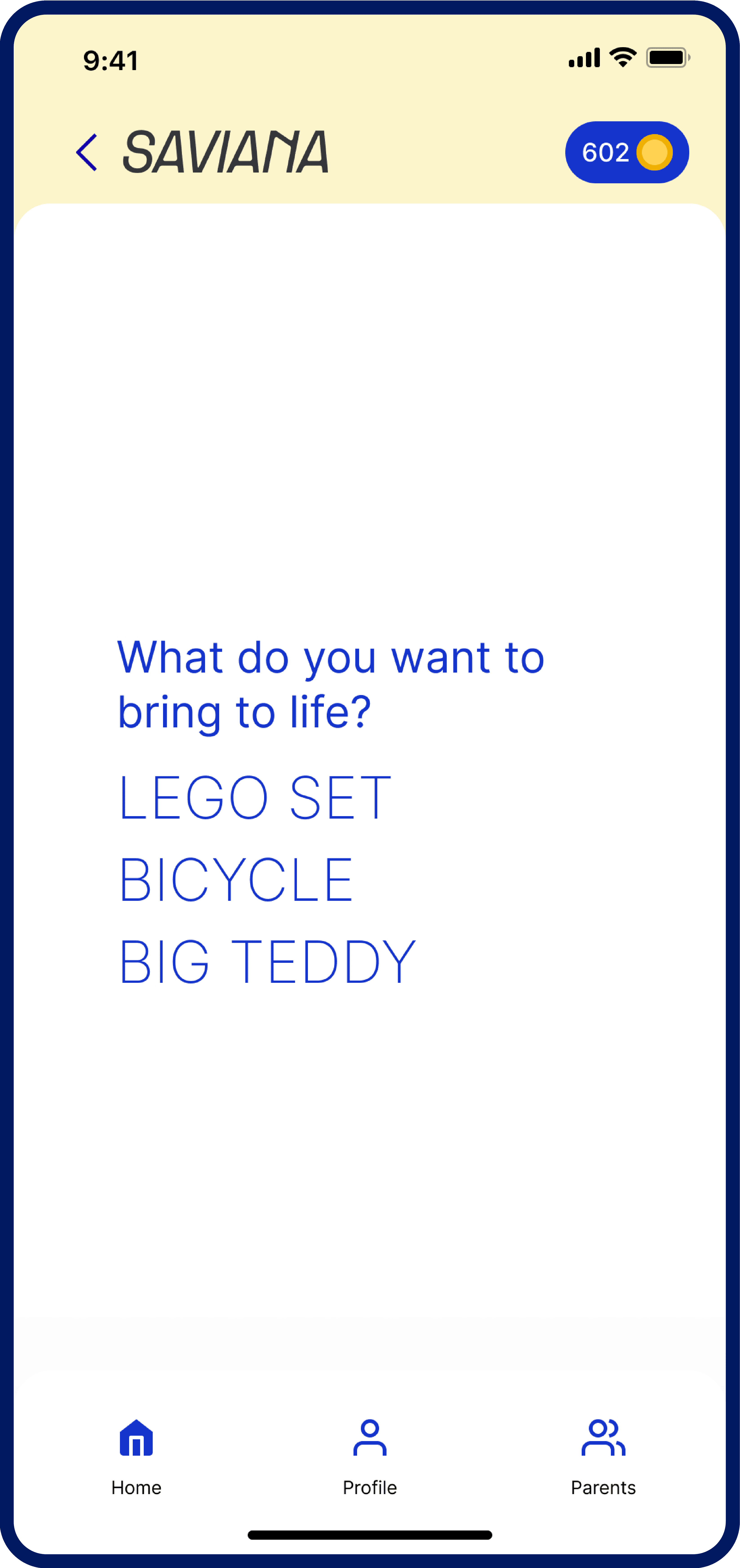

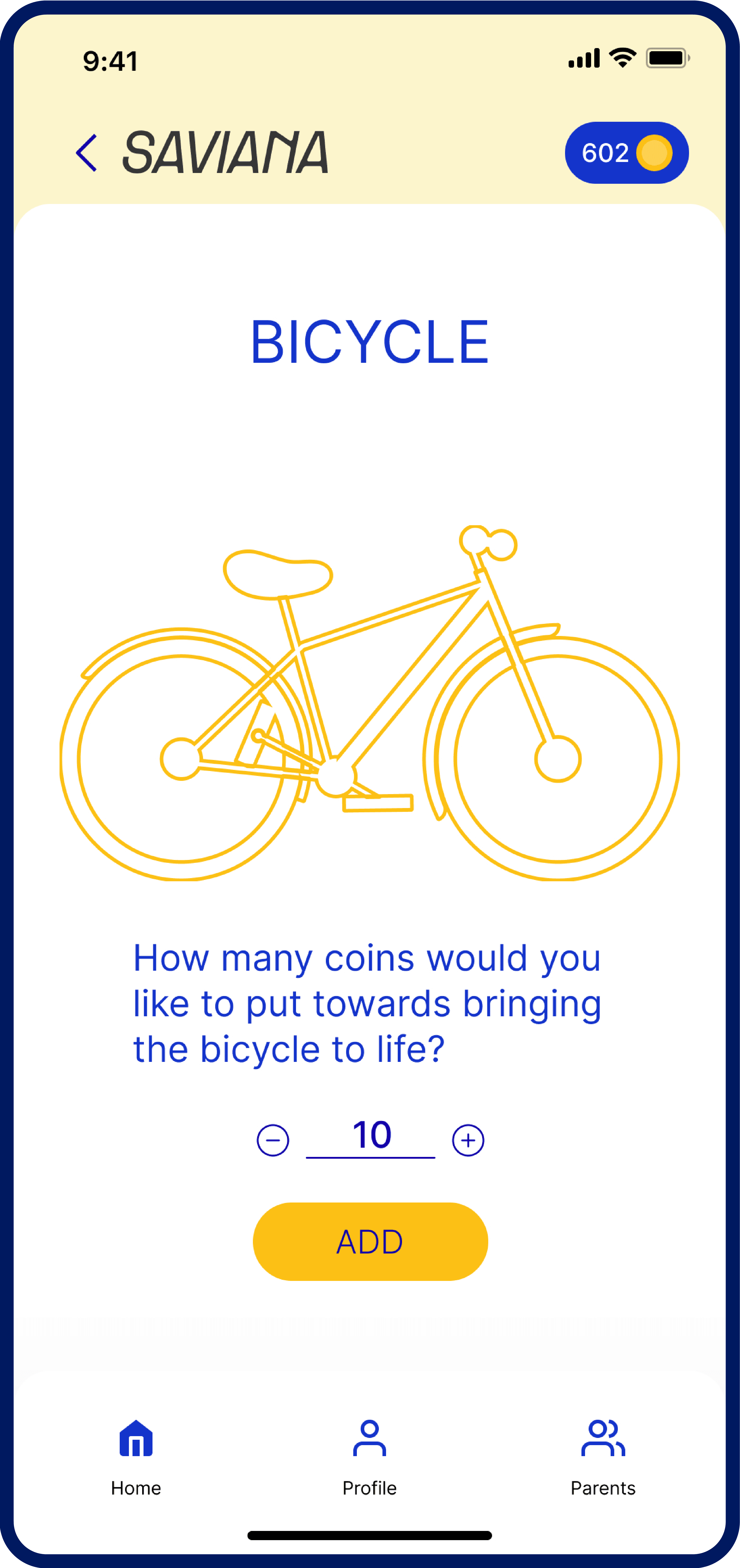

In this section, children will learn the value of saving and the patience it requires. They’ll discover how setting aside money over time can lead to fulfilling their goals. By understanding the benefits of delaying gratification, kids will develop a strong foundation in financial discipline.

In this section, children can dive into a collection of stories covering a variety of financial topics. These narratives not only make learning fun but also provide a screen-free alternative that parents will appreciate.

The profile section is where kids can view their transaction history, track their achievements, and access settings. It offers a clear snapshot of their progress, celebrating milestones and a manage their app experience.

Investing

Saving

Stories

Profile